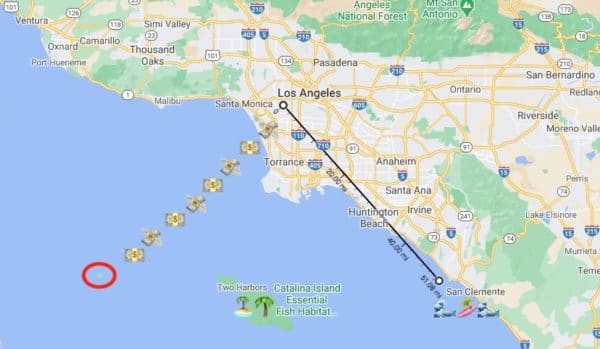

Before we get to the net worth update… I came across this funny old post from a couple years back called “Money Trails”…

Basically, it tells you how far your money will let you travel if you line up all your dollar bills, lengthwise, in a single long straight line…

Here’s how it works:

- Convert the length of your dollars (6 inches per $1 bill) to feet… $542,510 = 271,255 ft.

- Convert feet to miles… 271,255 ft = 51 miles

- Google map a radius of 51 miles from your home and pick a location

- Imagine laying all those dollars end to end to that location

From my home in Los Angeles, it looks like my money will take me down to my fav surf spot in San Clemente! Or, if my dollar bills could float (and I could walk on water), I could visit Catalina Island or that other tiny little remote island in the middle of nowhere on the left…

Unfortunately, I’d need a net worth of $26,252,150 to make it all the way to Hawaii. Or more than $35 million to visit my brother on the East Coast!

What a fun (and utterly useless) perspective on measuring your net worth! I’m curious… How far can YOU get with your current dollars? Here’s the original post if you want to check out instructions.

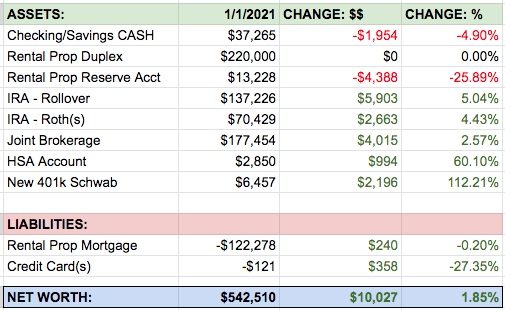

Jan 1 2021 Net Worth Update: $542,510 (+$10,027)

Sweet! Another $10k bump since last month’s report!

Here’s the account summary, as well as growth shown in dollars and percentages for each asset we’re tracking:

December Abnormal Expenses…

We stayed in Los Angeles for Christmas this year to comply with our lockdown orders. Although not traveling saved us a few bucks, we still had some hefty December spending — and a negative savings rate. 🙁 Here are the major things that hurt our wallet:

Tax bill paid for rental property: Technically this $5k bill wasn’t “due” until the end of January, but I hate having outstanding bills just sitting around so we paid it early. This was paid with our property reserve account, and tax isn’t due again until next January.

Christmas presents, a tree, food, and booze: We dropped another $600 or so this past month on presents (+ a tree!), in addition to our November gift spending. Our grocery bill was pretty killer this month ($627) which is quite high for a family of 2. But, some of these were fancy meats and stuff we don’t typically buy, plus contributing to family meals for Christmas. My birthday was on Dec 30th and my wife made a special beef wellington with expensive filet mignon – delicious and worth every dollar!

Lower income for school holidays: My wife isn’t paid as a salaried employee, so we miss paychecks over school holidays. Thanksgiving and Christmas breaks total over 3 weeks of missing pay! This is one of the reasons we sit on a large emergency cash fund, to see us through dips in income like this. Summer break hurts the most, which we’ll tackle somehow in a few months when the semester is coming to an end.

December good stuff and wins!

Stimulus payments, $1200: We got our stimulus payments on Dec 31st – a nice little way to end 2020. We qualify for these checks because we have less than $150k in combined income.

Teacher appreciation funds: Because my wife is such a kickass teacher, the families and students gifted her a total of $365 in vouchers and cash this Christmas! Thank you to all you parents out there who gift money to schools and teachers. I can’t tell you how well this is received by teachers and how much it makes them feel appreciated. THANK YOU.

Trash turned to treasure: Out on a morning run, I came across a compost tumbler that someone was throwing away. I snapped a pic, created a free ad on an app called OfferUp, and someone picked it up a few hours later for $40!

My conscience got the best of me the very next day… I noticed more free items and furniture out front of that same house and learned the people there were moving houses. I can’t imagine how much it sucks moving homes during a pandemic, so I ended up giving the $40 to the family as a moving present.

This is why I’d be a horrible business owner – I have a problem giving my profits away. At least I have a fun story to tell, and maybe some good karma down the road somewhere. 😉

Detailed Asset Breakdown:

CASH Accounts: $37,265 (-$1,954): We skipped a paycheck from my wife’s job this month, and also transferred some cash into our HSA account. This cash balance is trending downward, which is OK as it’s still higher than what we really need for our emergency fund.

Rental Property and Reserve Account: $233,228 (-$4388): We paid our property tax bill which accounts for $5,185 of this expense. Our positive cashflow was $797, which is the difference between $1,975 in rental income minus $1178 in total expenses. 🙂

IRA – Rollover: $137,226 (+$5,903): The increase in this account was solely from market growth and reinvested dividends. Someone asked me about why I don’t do a backdoor conversion of this account over to our ROTH… and the answer is that we plan to in future years. More to come on this topic!

IRA – Roths: $70,429 (+2,663): I’m excited to contribute to these Roths again in January for 2021. The plan is to transfer funds from our joint brokerage over these accounts to begin tax-free growth as early as possible within the year.

Joint Brokerage Account: $177,454 (+$4,015): I made some large buy/sell trades within this account in late December. Due to our low income in 2020, we were in a good situation to do large capital gains harvesting. Although we’ll pay a small amount of state income tax, we’ll pay 0% in capital gains tax and reset our cost basis for a bunch of stocks. At some point I’ll do a deeper dive into this account and explain what all that crap I just wrote actually means.

HSA: $2,850 (+$994): The increase here came from an after-tax contribution of $887.50 (prorated contribution for 2020) and the rest was market growth.

New 401(k) at work: $6,457 (+$2,196): This 401k has been only open for 3 months, so I’m proud that there’s already $6k in there. I get zero company matches, so this is mostly personal savings and a tiny bit of market growth.

Breakdown of Liabilities

Rental Property Mortgage: -$122,278 (+$240): If my calculations are correct, this mortgage balance will be less than $120k at the end of 2021 if I just leave everything alone. I could speed things up by making extra payments myself… but why do this when the tenants are paying it down naturally each month?

Credit Card Balances: -$121 (+$358): Other than this small credit card balance, my wife and I have no other consumer debt. 🙂

Overall, 2020 was a very good *financial* year for my wife and I. Since we only started sharing these monthly net worth reports in October last year, I can’t really give a complete and full 12-month comparison and overview. Something I promise I’ll do when I’ve got enough data!

How were your updates the past month? Share your milestones and juicy details in the blog comments — boasting is heavily encouraged! 🏆🏆🏆

Have a great weekend, peeps!

– Joel

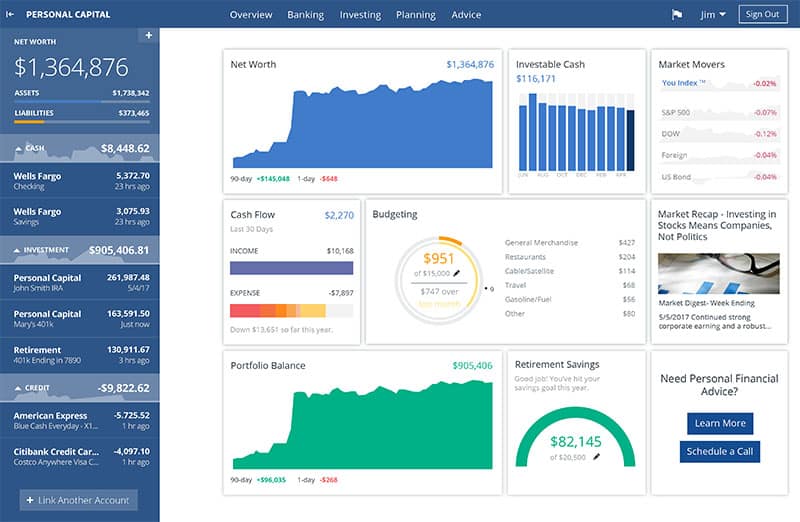

PS: If you’re just getting started in your journey, here are a few good resources to help track your money. Doesn’t matter which route you go, just that it ends up sticking!

If you’re not a spreadsheet guy like me and prefer something more automated (which is fine, whatever gets you to take action!), you can try your hand with a free Personal Capital account instead.

Personal Capital is a cool tool that connects with your bank & investment accounts to give you an automated way to track your net worth. You’ll get a crystal clear picture of how your spending and investments affect your financial goals (early retirement?), and it’s super easy to use.

It only takes a couple minutes to set up and you can grab your free account here. They also do a lot of other cool stuff as well which my early retired friend Justin covers in our full review of Personal Capital – check it out here: Why I Use Personal Capital Almost Every Single Day.

(There’s also Mint.com too btw which is also free and automated, but its more focused on day-to-day budgeting rather than long-term net worth building)

Joel is a 35 y/o Aussie living in Los Angeles and the guy behind 5amjoel.com. He loves waking up early, finding ways to be more efficient with time and money, and sharing what he learns with others. Rise Early | Retire Early!