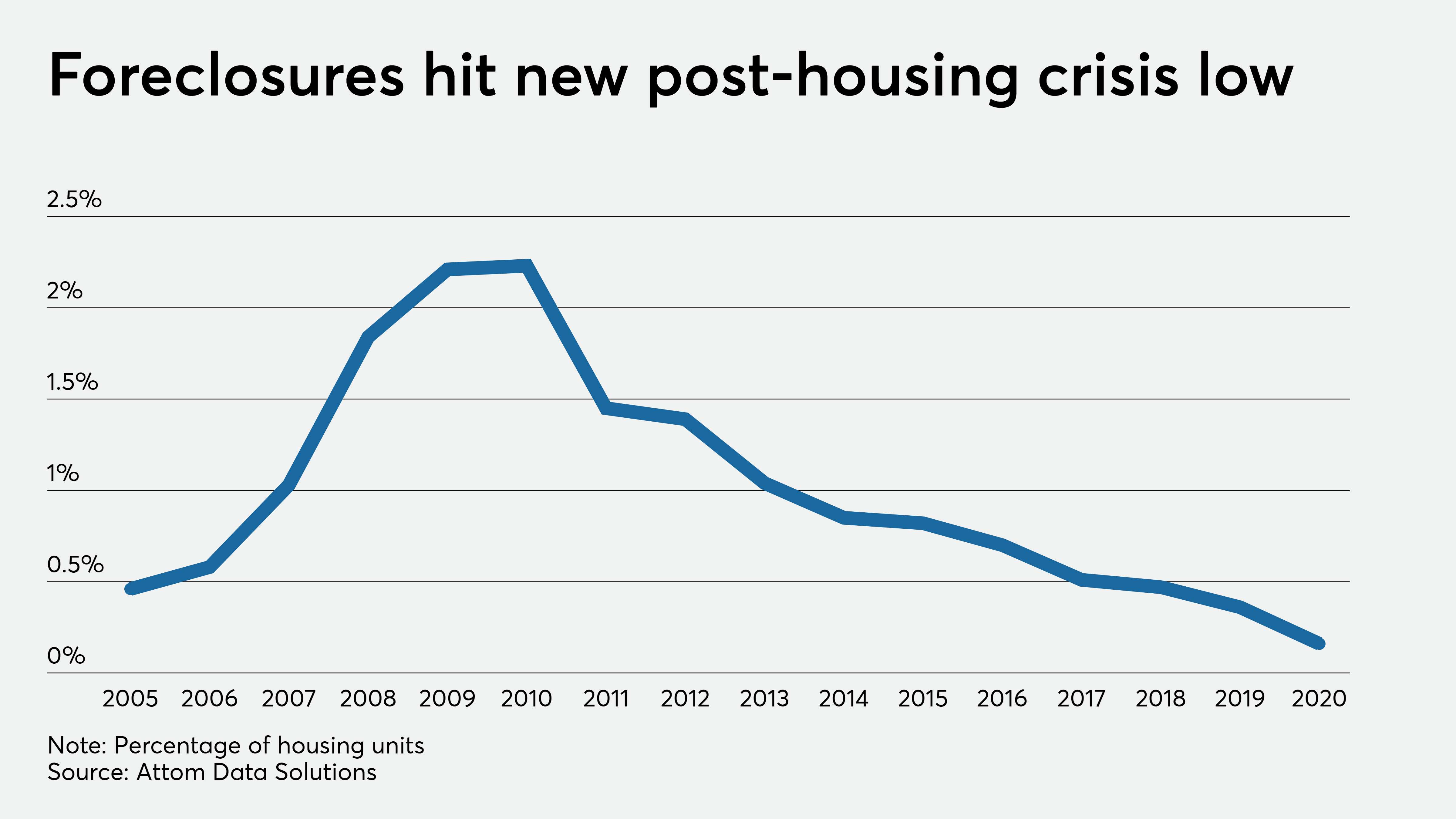

Foreclosure activity in 2020 plummeted 57% from 2019, but that could change dramatically once government moratoria expire, according to Attom Data Solutions.

Foreclosure filings totaled 214,323 properties — or 0.16% all U.S. properties — the lowest sum since Attom started its tracking in 2005. Comparatively, 2019 had 493,066 filings representing a 0.36% share of all properties. These numbers peaked at 2.9 million and 2.23% in 2010.

“There is a backlog of foreclosures building up — loans that were in foreclosure prior to the moratoria; loans that would have defaulted under normal circumstances; and loans whose borrowers are in financial distress due to the pandemic,” Rick Sharga, executive vice president of Attom’s consumer-facing business, RealtyTrac, said in the report. “While it’s still highly unlikely that we’ll see another wave of foreclosures like the one we had during the Great Recession, we really won’t know how big that backlog is until after the government programs expire.”

Although they dropped 80% from the year before, December’s foreclosure filings rose 8% month-over-month to 10,876 properties.

Delaware had the highest statewide foreclosure rate in 2020, at 0.33%. It was trailed by New Jersey’s 0.31% and 0.3% in Illinois. This marks the first time New Jersey hasn’t topped the list since 2015. The highest foreclosure rates at the metro level came in Cleveland, Chicago and Baltimore with rates of 0.34%, 0.3% and 0.29%, respectively.

Lenders repossession through foreclosure also hit a low point of 50,238 properties, down 65% from 143,955 in 2019 and 95% from 2010’s high-water mark of 1.05 million. In December, lenders took back 1,972 properties through completed foreclosures, down 2% from November and 86% from December 2019.

Foreclosure starts also sank to a record low, falling 61% to 131,372 units in 2020 from 335,985 in 2019 and down 94% from 2.14 million in 2009. At the state level, Oregon decreased the most annually at 79%, followed by declines of 77% in Arkansas and Kansas, and 71% in Nevada. Only Idaho saw an increase in foreclosure starts, climbing 4% from 2019. Among metropolitan areas with populations over 1 million, Jacksonville, Fla., and Las Vegas both dropped 74%, with Washington, D.C., and Memphis, Tenn., right behind at 72%.

“The impact of the government foreclosure moratoria and mortgage forbearance programs is nowhere more obvious than in the foreclosure start numbers from 2020. We ended the year with a near-record number of seriously delinquent loans, but historically low levels of foreclosure activity,” Sharga said. “The question remains how many homeowners whose finances have been affected by the pandemic will ultimately default on their loans, and whether the strength of the housing market will help cushion the fallout.”