I’m here to tell you the real truth. FIRE Blogging is a scam. It’s the only way to ‘retire early’ and I know the secret of how you can do it too!

All you have to do is be like me: Write a blog for free for 3.5 years. Then take it public and make -$117.09 writing it for another year. Then monetize it and make -$839 the next year. THEN in your 6th year of writing make $2,070.75 of profit and live on that. It’s super simple!

Just do daily work for 6 years and make a profit of $1,114.66 total: $185.78 a year or $0.26 an hour. It’s foolproof! It has almost as good of a return as an MLM 😉 !

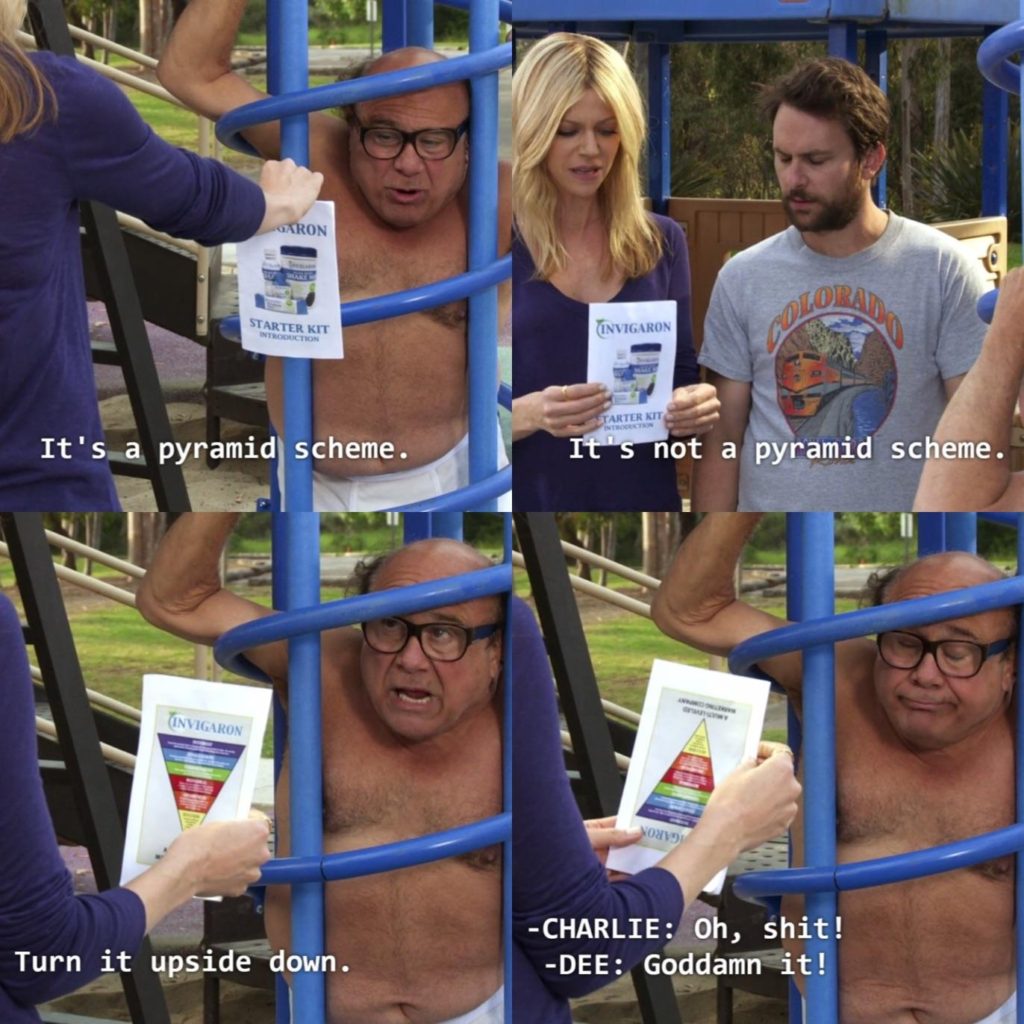

Always Sunny tellin’ it like it is.

Obviously, I’m completely joking. FIRE blogging generally would be a horrible plan to fund a retirement – or any lifestyle. I explained in this post about how blogging has turned out to be my dream job that it also pays basically no money. So then, why does it seem like the only way to retire early is to have a huge FIRE blog?

The Big Blogger ‘Camera Obscura’

As someone who was a lurker and reader in the FIRE community for years before peeking my head out and then raising my hand and then, years later, finally joining it, I think I can see this situation from both sides. Before I was a part of this community, I would see the same 5 bloggers or so, quoted in every mainstream article about FIRE. And those 5 bloggers had retired years ago, but also made a substantial amount from their blogs. And this is a weird tension.

More popular bloggers are by definition going to be making more money because of their larger audiences, so the bloggers I was more likely to hear about, are by definition bigger, money making bloggers. To put this into perspective, we actually hear from a relatively small percentage of actual early retirees because most (like my Mom) don’t have blogs. They’re just living their retired lives 🙂 .

Also, as I mentioned above, most people who have blogs, (retirees included) make basically no money from it. So FIRE bloggers that are big enough to be mentioned in mainstream media, are already usually a subset of two groups: retirees and bloggers who make money.

They are outliers, but because they are most of what we see, we can point to them and say “See! That’s the only way to retire early – to have a blog that shows people how to retire early!” It seems like the people who sell a book for a lot of money about how to sell a book for a lot of money. It’s a weird cyclical conversation that gives me pyramid scheme vibes. And this can appear to be the case, even if a FIRE blog in general (or the income from a blog) was not a part of the person’s original retirement plan.

Blogging Is Not A Great Income Plan

Putting aside the outliers for a second, the truth is that it’s actually quite rare to make any money from a blog and even more rare to make enough to live on. Income from a blog is also very unstable and is one of the first things to drop during a recession – marketing and advertising budgets get slashed, as we saw in March.

For example, the ad revenue from this site hasn’t yet recovered almost a year later. Some companies, understandably, started advertising less and other companies with affiliate programs I use cut the (already small) commissions or even lowered them to 0%. Also, unlike a salary, these changes can happen at any time. There is no guarantee you’ll make money from month to month.

Making Money From A FIRE Blog

So blogging in general is not a great plan if you’re looking to fund your lifestyle, but my situation in particular seems weirder because this is apparently a FIRE blog (or so it’s been called by others 😉 ). It’s basically a blog about me and I’m on FIRE, soooo I guess technically it’s a FIRE blog, though I’m sure that’s not apparent by the random topics I cover each week. I just write about whatever I feel like banging into this computer on a Wednesday morning, which often has little to do with money or financial independence in particular 🙂 .

But now I’m retired and I make a little money off of this blog. This is strange because I assume y’all are here reading this BECAUSE I was on the path to FIRE. If I was just some woman without a goal talking about random things every week, I imagine this would be far less interesting to you (let me know if I’m wrong in the comments 😉 ).

So it’s weirdly circular like the ouroboros below – the serpent that eats itself. This blog is fairly popular because I was on the path to retirement and now after 6 years, I’m making a little money off of this blog for that same reason.

That doesn’t look comfortable bro.

I’m obviously not rolling in the dough from blogging, but after all these years, I am making a little money from this blog and that feels weird and meta to me since it’s a blog about my money journey…which is now paying me a little for my time.

The meta weirdness of it was one of the reasons I was completely against monetizing this site in any way for 4.5 years. That and because I wasn’t sure it could be done in a way that didn’t make me feel weird or sleazy (Spoiler: It can 🙂 )

So talking about the journey is now partially funding the journey. Super meta. It would have been so much simpler if random other things I like to do were what after years of effort turned a profit, but alas, I’m too lazy to have more than one big hobby at a time 🙂 .

A ‘Pure’ Retirement

If you’re looking for a ‘pure’ case study of people who have made money in retirement (as it seems most do), but are NOT using that money so they can test if their original plan would have worked, check out Millennial Revolution. They created a separate portfolio where they stash their blog, book and other retirement earnings in order to see if their original $1 million CAD portfolio would have sustained them without the extra. So far it has.

I didn’t mean to have two images of Danny DeVito in his tighty whiteys in this post, but that’s just the way the cookie crumbled. Always Sunny is too iconic.

I am not a ‘pure’ case study for several reasons – one of which is that being open to and most likely accidentally making money, was always part of my plan – it’s one of the two levers (flexible spending and flexible earnings) that make me feel comfortable pulling the plug at 30 with an 100% stock portfolio.

I never claimed that my $500,000 would sustain me forever – this is an experiment with a lot of contingencies, but also an acknowledgement that – just like any retirement under the wrong set of circumstances – it could totally fail. However, failure has never really been my concern. And if failure is also defined by making money accidentally, I was almost 100% likely to fail.

So, in case you’re curious, I’m not trying to be a ‘pure’ case study and separate out my portfolios because:

- It would mess with my Roth IRA Conversion Ladder that I’m using to access my after-tax money before age 59.5

- It would make my taxes more expensive (for no good reason) and more complicated

- Most importantly: I’m lazy

The Internet Retirement Police

But what about the inevitable pushback? My partner has declared that he is a card carrying member of the IRP – the internet retirement police – and he says that the cultural perception or definition of a word is what it means, regardless of if that is true or accurate based on a dictionary. For example, the use of the word “literally,” which now means the exact opposite based on real world use.

While the FIRE space is trying to redefine ‘retirement’ as quitting your full-time job or doing whatever you want with your time, the stereotype and cultural definition of retirement is still being old and sitting on a beach and doing nothing that could possibly resemble work.

This is currently the case even though it’s not an accurate reflection of how older retirees spend their time. Most older retirees make money after quitting their full-time job either from necessity or desire. But how do we clarify the lack of facts behind these stereotypes and how does making money from a FIRE blog in retirement factor in?

Conclusion

So I’m retired and I make money from this blog. The small amount I’ve made is not what allowed me to retire early (as I try to make clear by sharing all my numbers) and any money I might make going forward, is not what will allow me to stay retired (the hundreds of thousands I saved before quitting are doing the heavy lifting 😉 ).

And now that I think about it, the fact that I’m deciding in October if I’ll reduce the frequency of posting here or even stop blogging all together, is just another example of how this income is not key to my plans before or during retirement. I don’t need it and I didn’t count on it or ever imagine that I’d even make it since, as I’ve said, a majority of blogs never make much money and I’m a realist 🙂 . However, even though I didn’t factor this accidental income into my plans, I did suspect from looking around at other early retirees, that I would possibly earn some money in retirement – I just didn’t know from what.

Because of my hopefully 70 year retirement timeline, I’ve always been open to making money in the future. I was never going to blindly pull 4% of my starting portfolio every year and see what happened. Flexibility is at the heart of why I feel comfortable quitting this young: flexibility to spend less and earn some money if needed.

Anyway, enough about me. I don’t have a solution or answer to this weird meta-problem we have in this community, but I did want to talk about it because the situation is just that: Weird. I hope my rambling thoughts can start a discussion about this strange reality and how we can all handle it going forward.

What do you think about FIRE blogs making money after retirement?