If you’re focused on paying off your mortgage, good for you. It’s generally always good to pay down debt. However, I’d also like to share with you the biggest downside to paying off your mortgage that may surprise you.

It’s been six years since I paid off my rental property mortgage. It was a mortgage for $464,400 I took on in 2003.

For the first year after paying off my mortgage, I felt great. But after that, the satisfying feeling of getting rid of debt wore off.

Perhaps the reason why the feeling was so ephemeral was because there was no congratulations card or fancy French Laundry dinner celebration. The only thing that changed was an extra $1,308 in cash flow, which went straight to savings or investing.

Before taking on this mortgage, I experienced an eerily similar feeling of ambivalence in my early 20s. After working for 60 – 70 hours a week from 1999 – 2001, while saving 100% of every bonus and 50% of each paycheck, I started thinking: what’s the point of it all?

Maybe I was experiencing a quarter life crisis back then. What I did know was that my enthusiasm for working in finance faded after the September 11, 2001 terrorist attack.

In 2003, with my lack of enthusiasm, I was *this* close to leaving San Francisco for Honolulu until I found a 2/2 condo overlooking a park in Pacific Heights for $580,000. Once I took out the $464,400 mortgage, my motivation to work hard shot through the roof!

Suddenly, my paycheck felt meaningful because if I stopped paying, I’d lose my $116,000 down payment and trash my credit score. Without dependents, finally, I had something tangible to work hard for.

The Biggest Downside To Paying Off Your Mortgage

The biggest downside to paying off your mortgage is the complete loss of motivation to take risks and work as hard as you can.

Once you have no mortgage, you no longer have as much fire to improve your finances. You may start slacking off in your career or entrepreneurial endeavors as well.

A mortgage keeps you hungry.

Think about it. Without a mortgage, life is relatively easy. Your living costs drop down to hardly nothing. Food is abundant and cheap in this country. Meanwhile, there are a lot of cheap or free things to do for fun.

When life is easy, we tend to get soft. Not only do we get out of shape, we neglect our relationships, and ignore our finances.

When you’ve got everything covered, only the craziest of people bother to take risks. It’s irrational to work hard if you have no financial burden. When nobody is depending on you, there’s no pressure to provide.

Forget about trying to start your own business on the side or get promoted when you can just enjoy life now. The biggest downside to paying off your mortgage early may be indifference.

How A Mortgage Affects Behavior

Back in 2015, I made a new year’s resolution to pay off the rest of my ~$91,000 mortgage. I unleashed an inner money-making beast.

Instead of continuing to leisurely consult part-time for 15-20 hours a week at Personal Capital, I got motivated to look for more consulting work.

Due to my desire to pay off my mortgage debt that year, I ended up taking on two more consulting jobs for a total of 60 hours a week for three months. One company was a Series Seed startup out of Y Combinator. Another company was a Series B startup in the finance space as well.

All three companies were fascinating to consult for. For three months, I was making around $30,000 a month. I used all of the money to pay down mortgage principal and invested the remaining 20% in the S&P 500.

Having a mortgage made me want to boost my income. Three months of working 60 hours a week with three firms was as much as I could handle.

Took Things Down A Notch

As soon as I wrote the final mortgage check in 2015, my whole attitude changed. First, I stopped looking for more consulting work even though two out of the three contracts ended. Second, I decided to go on a 3.5 week trip to Asia to live life like a digital nomad.

I then spent several days up in Yosemite to see if bears poop in the woods. Then I went to New York City for two weeks to watch the US Open and see some friends! Once I paid off my mortgage, I began to completely slack off!

There was little motivation to try and maximize income. Why bother when the mortgage was already paid off? Back then, I was still $50,000 away from my $200,000 a year passive income target too. It didn’t matter. I wanted to relax.

Sure, not having to consult anymore meant less stress and a healthier lifestyle. But it’s not like I was stressed or unhappy working those hours in the first place. Instead, I was thrilled to be able to do what I wanted to do while making a very healthy income. Something new was happening every day at one of those three companies.

The biggest downside to paying off your mortgage is really the loss of motivation to try new things. Only when your back is against the wall will you do everything possible to change. Having a mortgage is like an implicit back stop to not slack off.

Below is a snapshot of my last mortgage payment on 5/12/2015 for the condo I bought in 2003.

My last mortgage payment on 5/12/2015. Balance was $464,000 in June 2003

A Recent Example Of How A Mortgage Affects Motivation

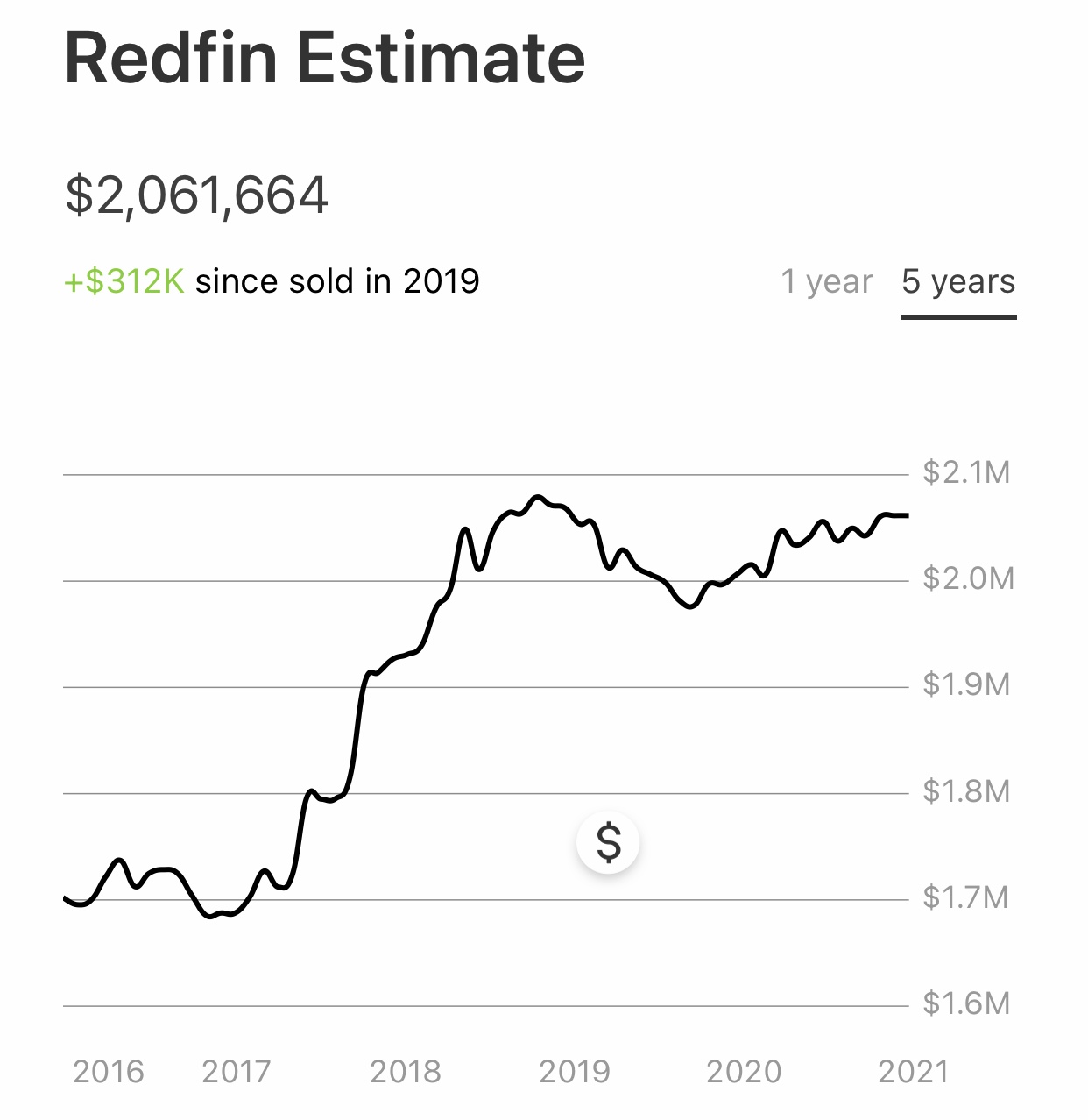

In early 2019, I bought a single family home fixer for cash. I went through a pretty arduous negotiation process that required writing a real estate love letter, a real estate breakup letter, and more.

In the end, I thought I got a great deal – maybe $100,000 – $150,000 below market price. I spent time remodeling the house to make it even better before moving in.

Then, as fate would have it, I found a really nice house a year and a half later right at the start of the pandemic. My wife thought I was nuts to buy another house so soon. However, it was in the neighborhood. It was also the perfect house for our larger family. The combination of potentially getting a good deal and providing a nicer living arrangement was too hard to pass up.

We bought it. With a new 7/1 ARM mortgage at 2.125% I was motivated to move into the new house immediately. So we did soon after closing. Every day we delayed moving into our new home felt like a waste of money due to the mortgage.

Took My Time Renting Out My Old House

With our old paid off house, I took a couple weeks touching up the house in preparation to rent it out. In the past, I would touch up the house in a couple days so it could be rented out ASAP.

Then, I passed on tenants who were willing to pay $150 a month more. They just didn’t feel right and I wanted to feel great about the tenants. I had no mortgage, so I could afford to wait.

By passing on these willing tenants, I had to wait another 7 days before finding my ideal tenants. When all was said and done, I gave up about $2,500 in rent over the course of a year.

If I had a mortgage on my rental house, I would have tried harder to find new tenants and signed with the first set of tenants. I just didn’t care as much for optimizing returns any longer.

More Reasons Not To Pay Off Your Mortgage

Here are some other reasons to not pay off your mortgage.

1) You lose your mortgage interest deduction.

The mortgage interest is treated like a business expense for rental property and a tax deduction if it’s your primary residence. The higher your tax bracket, the more valuable the interest expense.

For those in the 32% Federal tax bracket or higher, you get better value keeping your mortgage. The ideal mortgage amount is now $750,000, if you can afford it.

2) You lose a low borrowing cost.

Interest rates are at all-time lows thanks to the global pandemic. Therefore, it makes more sense to hold onto a low fixed mortgage rate for as long as possible.

Because I believe mortgage rates will tick slightly higher in 2021, all the more reason to refinance now or hold onto your lower mortgage rate today.

My current mortgage rate is at 2.125%. I won’t be focused on paying down my primary mortgage for a while.

Another thing to keep in mind is whether you have a primary home mortgage rate or a rental property mortgage rate when you’ve rented out your home. Rental property mortgage rates are usually ~50 basis points higher than a primary home mortgage rate. Therefore, if you are renting out your home with a primary home mortgage rate, you’re more incentivized to keep it.

The cash you save by not paying down your mortgage can conceivably be used to invest in other assets that provide a greater return.

3) You tie up capital in an illiquid asset.

Unless you have a very diversified net worth, having a lot of capital tied up in a property can be bad.

Your property could blow over in the next storm, or burn down in a fire. If you are underinsured, you will pay dearly as insurance companies make it difficult for you to receive full benefits from a claim.

Most Americans have a majority of their net worth (~80%) tied up in the home. When the housing market collapsed in 2007 – 2010, so did the net worths of millions.

Hence, I wouldn’t have more than 50% of your net worth in property and 25% of your net worth in your primary residence.

4) You decrease your financial returns.

If you put 20% down, a 4% appreciation on the property means a 20% cash-on-cash return thanks to leverage. For example: $100,000 down payment on a $500,000 house that appreciates by $20,000 means your equity increased by 20% to $120,000.

If you decide to pay off the other $400,000 in mortgage early, the return falls all the way down to 4%. You also don’t have $400,000 to invest elsewhere. Of course, there’s always a chance you could have invested the $400,000 in something that loses value.

5) You might start being less efficient with your time.

Instead of consulting for lots more money, I decided to spend my time discovering what it was like being an Uber driver back in 2015. After all expenses, I was only making $22-$25 an hour driving. But if I had found another consulting contract, I could have easily made 10X that amount.

If I had focused on growing Financial Samurai, perhaps I could have made much more. When it comes to making money, less debt can make you less financially disciplined.

But I decided to try out Uber driving because I was curious and fascinated with people’s stories. Some of these stories ended up on here. Further, making a lower income or close to minimum wage helped me appreciate the opportunities I have today.

If you find yourself spoiled, clueless, or taking life for granted, please work a minimum wage service job as an adult. Your dejection will clear right up!

6) A chance your credit score might take a hit.

Some of the variables that go into determining your credit score include the amount of debt you take out and paying your debt on time. Therefore, paying off your mortgage may reduce the strength in these variables.

If your credit score takes a hit, you may not be able to get the best interest rate for your next mortgage, car loan, HELOC, or personal loan. If your credit score is borderline excellent (~760) and you plan on taking out more debt in the future, perhaps paying off your mortgage is not the best move.

Conversely, if your credit score is well over 800, then paying off your mortgage won’t make a difference to your credit score.

A Mortgage Can Motivate Both Ways

In a curious way, a mortgage not only motivates you to build more wealth, a mortgage also motivates you to pay it down. If your property ends up appreciating in the process, then all the better!

Despite losing motivation to hustle after paying off your mortgage, paying off your mortgage early is still a worthwhile goal.

It feels great to have less debt or no debt. Every extra mortgage principal payment is progress towards more financial independence.

With a new mortgage, I’m more motivated to continue building wealth. But the reality is, I don’t need any more motivation. I have two young children that provide the greatest motivation of all.

Each child is like a mortgage itself, reminding me to not mess things up. In fact, my son the other day said the sweetest thing, “Daddy, thank you for working so hard to buy this house!” Once I heard those words, my motivation rocketed to the moon!

Mortgage And Retirement

Ideally, it’s good to have zero mortgage debt by the time you retire or no longer have a desire to make more money. The challenge is to time the outcome perfectly.

After playing around with the retirement planning calculator, I feel paying off all mortgage debt by 2031 is the ideal scenario. 10 years is a long enough time to leverage cheap debt to boost wealth. My motivation to hustle will likely fade in 10 years.

Figure out when you plan to retire and divide your debt by the number of years left you plan to work. The amount will be how much debt you have to pay down each year to reach your goal.

Let paying off your mortgage be a great motivator to boost wealth and stay focused. By the time you truly retire, I’m sure you’ll be thrilled at no longer having a mortgage.

Refinance Your Mortgage

Instead of paying off your mortgage, you should strongly considering refinancing your mortgage with mortgage rates at all-time lows.

Refinance your mortgage with Credible, one of the largest mortgage lending marketplaces where lenders compete for your business. You’ll get real quotes from pre-vetted, qualified lenders in under three minutes. Credible is the easiest way to compare rates and lenders all in one place.

In my opinion, mortgage rates have a high chance of going up in 2021. The Fed has promised to stay accommodative. Stocks and real estate are likely going to continue doing well. And the job market is making a comeback.

All these things point to higher inflation, which leads to higher interest rates. Refinance your mortgage now before rates go up. They have never been lower, but are finally starting to tick back up.