I used to hate filing my taxes. Every year I would complain, procrastinate, make excuses, then finally on deadline day I would take a messy stack of forms to my tax guy and cry for last-minute help. It wasn’t fun at all.

Then something changed. I grew up. I put a system in place. And lucky I did!

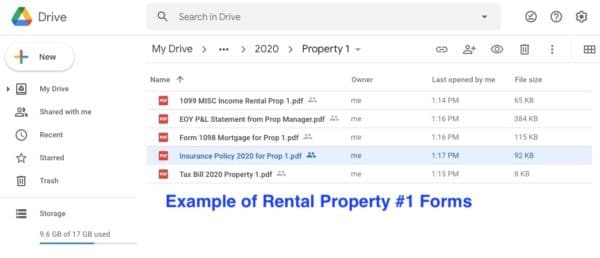

Today, even though my tax situation is more complicated than most families’, filing is an absolute breeze! (This year I’ll receive probably 18 x 1099’s and W2s for income/interest, I manage 5 physical rental properties — each of which has 5 or 6 tax forms and large numbers to crunch — some LLC company filings to do and various K1 statements from other partnerships.)

My tax organizer system really just boils down to a few simple steps — and being organized is 100% FREE. In this post I’m going to share these tips, and hopefully some of them can help you kick your 2020 tax return in the buttocks.

First of All: Check Yo’ Attitude!

If you think filing your taxes will be a sucky process, then it will be! I’m not saying you have to love every second of it, but try not to roll your eyes and think of all the negatives. That only makes it harder for yourself.

The more positive you think, the less painful it will be. The earlier you get your file submitted, the more free time you have to enjoy the year! The better you follow your tax organizer system, the easier it gets every single year going forward.

Let’s get started…

1. Create One Single Place for All Your Tax Docs

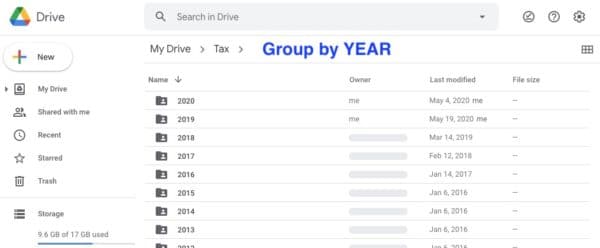

Your filing and folder system is the most important step. Personally, I use Google Drive to keep all my stuff, and there are several reasons why I like keeping it in the cloud. But, you can certainly have these files secure on your personal desktop, or do it old school with hard copies. Just make sure it’s all in one place.

Here’s what my drive looks like. All my years are in simple folders:

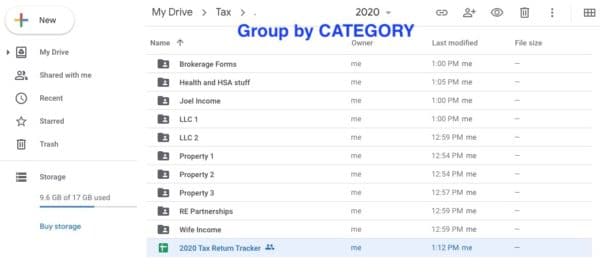

All tax documents are grouped by category. Personal income, investment forms, each rental property, partnerships and LLC business, and misc deductions each get a folder of their own:

Inside the folders are the actual tax forms, receipts and scanned files.

Pro Tip: Why I Store My Tax Files in the Cloud

The benefits of having my tax information stored in the cloud are:

- I keep zero paper in my house. Once I scan something and upload it, I recycle or shred the paper immediately. My online tax organizer is slim, out of sight and out of mind.

- Using Google Drive, all my forms are searchable (provided I label them correctly).

- I can work on my tax return anywhere, on any device. This is important for steps #3 and #4 below.

- I can share these online folders and private links with my tax team (instead of trying to email 100Mb of attachments and scans to them). My accountant LOVES this system.

2: Create a Quick Tax Tracking Worksheet

The purpose of the tracking sheet is to help you compartmentalize all of the docs and forms that make up your return, as well as keep track of what you have received vs. what you are still waiting on.

Here’s a look at my tracking sheet for 2020 (example). Feel free to download this basic sheet here: tax doc tracking template and make your own modifications.

![]()

Each year, I find my previous year’s tracking sheet and cut/paste all the data to start a new sheet. It’s a template I use over and over again and most of my forms and tax documents stay the same each year.

Eventually, when I send all the information over to my tax team, I also send this sheet to help them find everything within the folders. I try to label every form specifically, and I put special notes if there’s something different from last year.

3. Scan, Save, and Track All Tax Forms as Soon as You Get Them!

Through the beginning months of the year, you’ll start to receive forms. W2’s and 1099s from employers, bank forms, investment stuff, etc etc. Some of these forms will come via postal mail, some will be sent to your email, and some you’ll have to log into portals to find.

Try and get in the habit of opening, scanning, filing, and noting in your tracking sheet as soon as you receive a document.

It takes me about 3 minutes when I get sent a tax form or statement. I open my mail, grab my iPhone, use a free app called Scannable to take a photo of the form, and immediately upload it to the relative folder in my Google drive. Then I quickly open the tracking sheet in Google Sheets, and note what I received. Done.

Same thing when I get an email saying, “Your 2020 tax forms are ready to download”… I stop whatever I’m doing, log into the bank or whatever portal, download my forms, upload it to my drive and track it. Literally done under 5 mins.

Instead of spending months drowning in documents and trying to remember where I put all the forms, my annual filing process is broken down into simple 5-minute activities. Easy stuff!

4. Track Receipts Throughout the Year

Just like the step above, having a quick and easy way to store receipts throughout the year makes it 100 times easier when filing time comes.

For those of you who use Mint.com to track your expenses, there’s actually a label you can assign to different transactions throughout the year. I check this every month when doing our budgeting exercise (although not many of my expenses are deductible).

For Personal Capital users, the same can be done in their system under the transaction tab.

Doesn’t matter if you think you’ll be doing an itemized deduction or taking the standard deduction (apparently 90% of households just take standard deduction), it’s still a great practice to label each expense related to tax!

Reviewing them at the end of each tax year ensures you’re not skipping over any tax deductions and claiming every single cent that you are entitled to.

5. Create a Yearly Summary of Changes

One cool habit I’ve started is creating a simple list of relevant events that happened throughout the year. My CPA dude needs to know what happened in the past year so he can make sure I’ve received all the right forms and file a complete and correct return.

Here’s an example of major events or life changes that can affect your taxes:

- Changed employers

- Gifted to charity

- Contributed to 401k

- Added after-tax funds to HSA

- Got a stimulus check (I’m 99% sure these are not taxable income, but you’ll prob have to note what you received regardless)

- Shut down a business or LLC

- Bought property, sold property, refinanced, etc.

- New dependents to claim

- Got married → individual changing to file jointly?

- Other necessary personal information

- Etc…

My guess is some of you guys already add this stuff in your net worth tracking or annual finance reviews. It’s always handy to keep general information like this recorded with your income tax organizer.

6. Hand Over Your Docs as Neatly as Possible

There are 2 ways you can hand off tax documents to your tax preparer…

The first way is to dump a messy pile of mislabelled and unorganized documents on their desk. Then, somehow expect them to know everything you did throughout the year, prioritize you over their 5,000 other clients, and magically get you the biggest refund possible.

OR …

The other way is to organize all your docs into a neatly wrapped present — with a bow on top. You can provide a tidy, well-explained cover letter with your annual events summary and instructions on where to find everything they need within your filing system. If you do this early in the year, you will be prioritized and they will LOVE YOU.

Remember, your tax preparer is busy this time of year. They probably work 80-100 hours during tax season, and anything you can do to make their job easier will make you stand out over other clients.

I aim to be my tax team’s favorite client each year. It’s not because I pay them more money than their other clients — it’s because I’m the easiest to work with.

**********

This was supposed to be the end of the article! But I emailed a draft copy to my brother, and he pointed out some additional cool stuff. With his permission, I’m sharing his notes…

I was thinking, there are other benefits outside of tax when all this comes in handy, example:

1) This year I applied for a mortgage and I had to upload a buttload of documents. I just counted. I uploaded 67 separate PDF’s to the bank, and that doesn’t include about 5 that I emailed them directly or had them call my insurance people. The process has taken about 2 MONTHS because of all the stuff we have — the wealthier you get, the more complicated it gets. Having a system in place to find past financial documents without much effort really pays off!

2) Similar process when Baby M was born, although I wasn’t 100% on the ball, I was pretty good. I collected all the medical bills that arrived over MONTHS, which are designed to confuse you and deliberately obfuscate the mess that is our medical system. I put each in a spreadsheet and then I could easily spot the duplicate bills, the ones that had no Explanation of Benefits, etc. You can then call them all on their bullshit and plan which bills to protest and which to ask for discounts on. Most importantly it got me a clear picture.

3) You never know when you’ll need this stuff mid-year for one-off things. For example,

– Applying for mortgage or other credit without a lot of warning. Asking for previous income amounts or tax info.

– You might apply for a job and be asked to prove your financial stability (eg, when negotiating a salary based on your last salary, or if you hold an office where you need to prove you are financially not a risk for bribery, etc).

– Every now and then I need to look up my kids’ SSN numbers and I know where they are with all the other info.

Anyway, just some thoughts about why this is a handy process outside of taxes!

**********

Ready to join the secret society of ninja tax organizers? Tell us your other efficiency methods in the comments below so we can all learn each other’s tricks. 🙂

Joel is a 35 y/o Aussie living in Los Angeles and the guy behind 5amjoel.com. He loves waking up early, finding ways to be more efficient with time and money, and sharing what he learns with others. Rise Early | Retire Early!